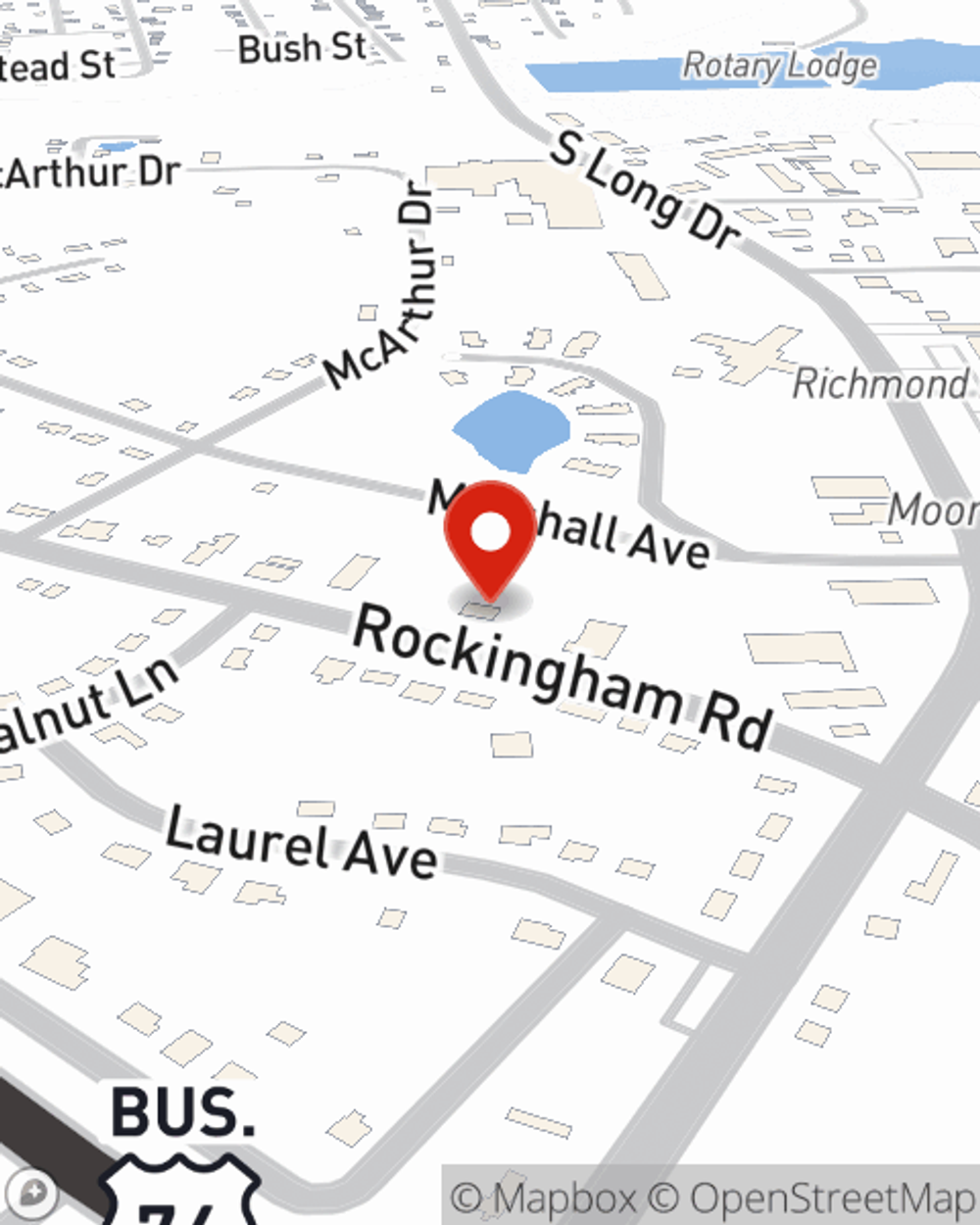

Life Insurance in and around Rockingham

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Richmond County

- Moore County

- Rockingham, NC

- Ellerbe, NC

- Hamlet, NC

- Seven Lakes, NC

- West End, NC

- Pinehurst, NC

- Southern Pines, NC

- Whispering Pines, NC

- Aberdeen, NC

- Fayetteville, NC

- Hoffman, NC

- Marston, NC

- Laurel Hill, NC

- Laurinburg, NC

- North Carolina

- South Carolina

- Scotland County, NC

- Monroe, NC

- Matthews, NC

Your Life Insurance Search Is Over

When facing the loss of a family member or your spouse, grief can be overwhelming. Regular day-to-day life halts as you prepare for funeral services arrange for burial, and come to grips with a new normal devoid of the one who has died.

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Put Those Worries To Rest

Having the right life insurance coverage can help loss be a bit less stressful for your family and provide space to grieve. It can also help cover bills and other expenses like home repair costs, grocery bills and future savings.

With responsible, considerate service, State Farm agent Tina Miller can help you make sure you and your loved ones have coverage if the unexpected happens. Visit Tina Miller's office now to get started on the options that are right for you.

Have More Questions About Life Insurance?

Call Tina at (910) 895-2447 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Tina Miller

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.